Understanding property tax rates (1%–2.5%) is crucial for real estate investors. Rates vary based on location, property type, and market value, with urban areas typically higher. Economic conditions, local decisions impact fluctuations. Investors must factor these rates into budgeting and loan eligibility. Calculating taxes involves multiplying assessed value by the rate. Strategies to lower rates include refinancing and tax professional advice for maximizing deductions.

In today’s dynamic investment landscape, understanding property tax rates is paramount for both novice and seasoned investors alike. These rates significantly influence the return on investment, often representing a substantial portion of total costs. However, navigating the complexities of varying tax policies across jurisdictions can be daunting. This article provides a comprehensive overview, aiming to demystify property tax rates and equip investors with the knowledge to make informed decisions. By delving into key factors, case studies, and expert insights, we offer valuable guidance for maximizing returns while adhering to legal obligations.

Understanding Property Tax Rate Basics

Understanding property tax rates is a cornerstone for investors navigating today’s real estate market. These rates vary widely across jurisdictions and significantly impact investment profitability. The property tax rate, expressed as a percentage, determines the portion of a property’s assessed value that owners or investors must remit annually to local governments. This assessment often considers factors like location, property type, and market value. For instance, in urban centers with high land values, property tax rates tend to be higher than in rural areas. Investors should also note that these rates can fluctuate based on economic conditions and local political decisions.

For borrowers considering investment properties, understanding the property tax rate is crucial for budgeting and financial planning. Lenders often factor this rate into loan eligibility criteria, assessing its impact on the borrower’s ability to meet repayment requirements. A typical range for property tax rates sits between 1% to 2.5% of a property’s assessed value, though this can vary. Investors aiming for long-term holds may find comfort in stable, predictable tax rates, while those with more active investment strategies must remain agile and informed about potential rate changes.

Effective investment strategy incorporates awareness of local property tax rate borrower requirements. This knowledge enables investors to make informed decisions on suitable locations, property types, and financing options. Keeping abreast of tax policy developments can also reveal opportunities for maximizing returns or mitigating risks. In today’s dynamic real estate landscape, understanding the property tax rate is not merely informative; it’s an essential tool for successful investment.

Factors Influencing Property Tax Rates

The property tax rate is a pivotal factor for investors navigating today’s real estate market. Several intricate factors influence these rates, each playing a significant role in shaping the financial landscape for both property owners and potential borrowers. Among these, location stands out as a primary determinant; municipal, state, and regional governments often set property tax rates, which can vary widely across different areas, reflecting local economic conditions, infrastructure needs, and service provision.

Demographics also contribute substantially to property tax rate dynamics. Population density, age demographics, and income levels within a community can significantly impact the services demanded and, consequently, the tax burden allocated to properties. For instance, urban centers with higher populations and above-average incomes typically support robust public services, which might translate into slightly higher property tax rates compared to more rural or lower-income areas.

Moreover, property tax rate borrower requirements enter into play when considering investment strategies. Lenders often factor in the local property tax environment when assessing loan eligibility and interest rates. A prospective investor with a specific financing plan should be aware that properties in jurisdictions with higher tax rates might require larger down payments or face slightly higher interest charges. This is particularly relevant for borrowers seeking mortgages, as their required outlay can be influenced by the property tax rate structure of the targeted location.

Understanding these factors empowers investors to make more informed decisions. Staying abreast of local government initiatives and service developments that could impact property taxes allows for strategic planning. Additionally, engaging with real estate professionals who have a deep understanding of the market dynamics can provide valuable insights into areas offering favorable property tax rate environments, thereby enhancing investment opportunities.

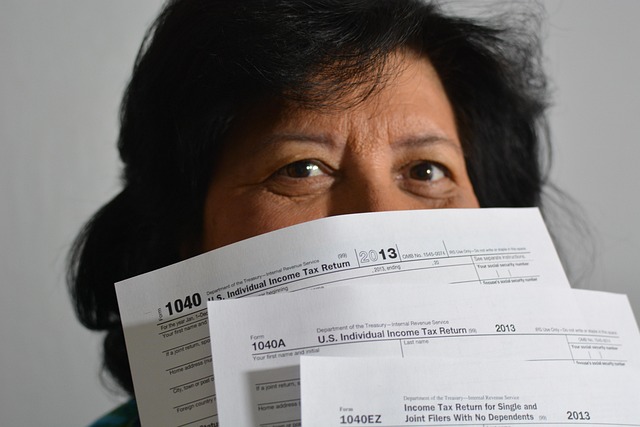

Calculating Your Local Property Tax

Calculating your local property tax is a critical step for investors looking to navigate the financial landscape of real estate investments. The property tax rate can significantly impact an investor’s return on investment (ROI), making it essential to understand how these rates are determined and applied. Local governments calculate property tax rates based on a variety of factors, including assessed value, local revenue needs, and regional economic conditions. For instance, in urban areas with high real estate values, property tax rates tend to be higher than in rural or suburban districts.

To accurately gauge your potential property tax obligations as an investor, start by assessing the property’s value. This is typically done through a local assessment roll, which lists all taxable properties and their appraised values. Once you have the assessed value, the property tax rate—expressed as a percentage—is applied to calculate your annual tax bill. For example, if your property is valued at $500,000 and the local property tax rate is 2%, your annual property taxes would amount to $10,000 ($500,000 x 0.02). Investors should also be aware that property tax rates can vary between jurisdictions, even within the same city or county, so it’s crucial to research the specific location of potential investments.

Understanding your borrower requirements is another vital aspect. Lenders typically factor in property taxes when calculating loan-to-value (LTV) ratios and determining interest rates. A higher property tax rate may increase these costs, affecting the overall affordability of an investment property. For instance, a property with a $30,000 annual property tax bill and a mortgage of $200,000 would have a higher LTV ratio than one with only $10,000 in annual taxes. Therefore, investors should anticipate these costs when planning their financial strategy and ensure they have adequate cash reserves to cover them, especially during the initial months of an investment.

Strategies for Lowering Property Taxes

Property tax rates can significantly impact investors’ returns, making strategies for lowering these rates a crucial aspect of savvy investing. While property tax rate laws vary widely by location, understanding borrower requirements and available deductions is essential. One powerful strategy involves leveraging mortgage interest as a deductible expense. According to recent data, the average U.S. household saves approximately $3,500 annually on property taxes due to mortgage interest deductions. This underscores the substantial potential for tax savings through responsible borrowing.

For investors, optimizing property tax rates involves a multi-faceted approach. First, borrowers should consider refinancing options to take advantage of lower interest rates, which can translate into reduced property tax obligations. Additionally, understanding and maximizing depreciation allowances can substantially decrease taxable income related to property ownership. Expert advice suggests that investors allocate time and resources to accurately track and document all eligible deductions, ensuring compliance with tax laws while maximizing savings.

A practical example illustrates this point effectively. Suppose an investor owns a rental property in a high-tax area; by strategically refinancing from a 4% interest rate to 3%, they could save thousands annually on property taxes. Moreover, employing a property tax consultant or accountant specialized in real estate investments can unlock additional deductions and credits, further lowering the effective property tax rate. In today’s competitive market, these strategies offer investors a powerful tool to enhance their financial returns while navigating borrower requirements efficiently.