Understanding property tax rate basics is crucial for real estate investors. Rates vary based on location, property type, assessment value, and local economic factors. Investors should monitor fluctuations, consult professionals, leverage deductions and exemptions, optimize loan terms, and diversify investments to minimize the impact of property tax rates on investment returns.

In today’s dynamic investment landscape, understanding property tax rates is paramount for savvy real estate investors. This complex yet crucial aspect often poses significant challenges, especially with varying local regulations and ever-changing market conditions. Investors face the intricate task of navigating these rates to maximize returns while adhering to legal obligations.

This article provides a comprehensive overview designed to demystify property tax rates, offering valuable insights for informed decision-making. We’ll explore key factors influencing these rates, dispel common misconceptions, and equip readers with strategic tools to optimize their investment strategies in light of these critical financial considerations.

Understanding Property Tax Rate Basics

Understanding Property Tax Rate Basics is a crucial step for investors looking to navigate the real estate market effectively. The property tax rate is essentially the percentage of the assessed value of a property that a borrower is required to pay annually as a tax. This rate varies widely depending on the location and type of property, making it a key variable in investment decisions. For instance, residential properties in urban areas often command higher tax rates due to the higher assessment values and the extensive local services they benefit from, compared to rural or suburban properties.

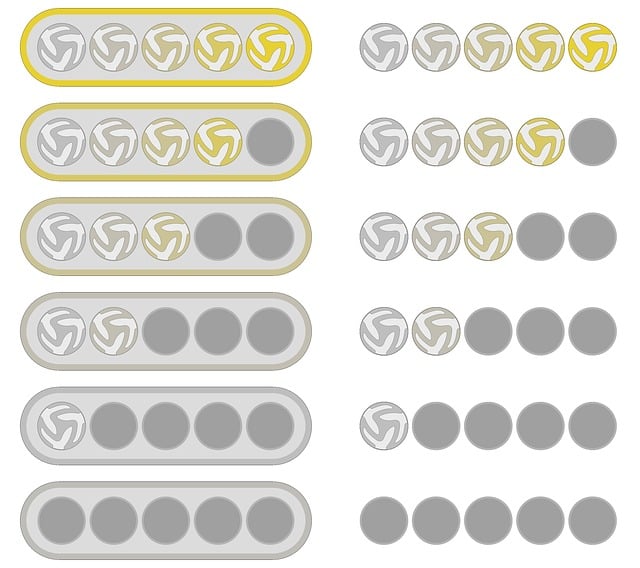

Property tax rate borrower requirements can significantly impact an investor’s return on investment (ROI). In many jurisdictions, property taxes are a major source of revenue for local governments, which fund essential services like schools, infrastructure, and public safety. Borrowers are typically responsible for paying these taxes directly to the taxing authority, usually on an annual basis. A 1-2% property tax rate is common in some areas, while it can reach 3% or more in highly assessed markets. Understanding and accounting for these rates during the initial investment planning stage is essential to ensure financial stability and predictability over the long term.

Investors should also be aware that property tax rates can fluctuate based on market conditions and local political decisions. Property assessments, which determine the base for calculating taxes, often change periodically as property values rise or fall. For instance, a robust real estate market with increasing property values may lead to higher tax assessments and, consequently, higher property tax rates. Investors should stay informed about these trends to anticipate potential impacts on their investments. Additionally, consulting with local real estate professionals and financial advisors can provide valuable insights into the specific property tax rate borrower requirements in target areas, enabling more informed decision-making.

Factors Influencing Your Local Rates

Property tax rates are a significant factor for investors to consider when entering any real estate market. These rates vary greatly from one locality to another, influenced by a multitude of factors that can change over time. Understanding these local influences is key to making informed investment decisions. For instance, property tax rates in urban centers tend to be higher due to the increased demand for services and infrastructure, while rural areas often enjoy lower rates because of reduced service requirements.

One primary factor driving property tax rate variations is the local economy. Areas with strong economic growth and high per-capita incomes usually support higher property tax rates to fund public services and amenities. Conversely, struggling economies may opt for lower rates to attract new businesses and residents. Another critical element is population density; densely populated areas often have higher tax rates as they require more extensive service provision. Property tax rate borrower requirements also play a role; lenders typically consider local tax rates when assessing the affordability of property investments, setting criteria that borrowers must meet.

Furthermore, property tax rates are influenced by the types and ages of properties in an area. Older buildings may have lower assessment values, leading to reduced tax rates, while new developments often face higher assessments. Local government policies on property taxes can also vary, with some regions offering exemptions or discounts for certain types of properties or income groups. For instance, senior citizens or veterans might qualify for property tax relief programs. Investors should remain updated on such policies as they can significantly impact their overall investment strategy and financial obligations, especially when considering the property tax rate borrower requirements.

To stay ahead of these fluctuations, investors should regularly monitor local government budgets and assessment practices. Engaging with community leaders and real estate professionals can provide valuable insights into upcoming changes in property tax rates. By staying informed about these factors influencing property tax rates, investors can make more accurate predictions, negotiate better terms with lenders, and ultimately maximize their investment returns while adhering to the dynamic requirements of local tax regulations.

Calculating Property Tax: Step-by-Step

Calculating property tax is a critical aspect of investing, especially for those navigating the complexities of real estate markets. The process involves several steps to determine the precise property tax rate applicable to borrowers, which significantly influences their financial obligations and overall investment strategy. Firstly, assessors evaluate the value of the property, utilizing various methods like market comparison, cost analysis, or income capitalization. This assessed value forms the basis for calculating the property tax bill.

Once the property’s worth is established, the local taxing authority applies a predetermined property tax rate to the assessed value. These rates vary widely across jurisdictions and are often expressed as a percentage. For instance, a property in County X might be taxed at 1.5% of its assessed value, while a similar property in City Y enjoys a lower rate of 1%. Understanding these varying rates is crucial for borrowers, as they directly impact the tax burden and must be factored into any investment decision.

Borrowers should also be aware that lenders typically incorporate a buffer to cover property tax fluctuations in their mortgage calculations. This buffer, often represented as an additional 2-3% of the property’s assessed value, ensures that payments remain adequate even if tax rates increase. For example, a borrower with a $500,000 property and a 1% property tax rate would budget approximately $5,000 annually for taxes based on their mortgage payment alone. This step-by-step approach to calculating property tax rates equips investors with the knowledge to make informed choices, manage cash flow effectively, and navigate the complexities of real estate investments with confidence.

Strategies for Lowering Tax Obligations

Property tax rates can significantly impact an investor’s return on investment, making strategies for lowering these obligations crucial. A deep understanding of local market dynamics and legislative loopholes is key to navigating this landscape effectively. One proven method involves leveraging deductions and exemptions offered by various jurisdictions for specific property types or use cases. For instance, investors focusing on commercial real estate may benefit from depreciation deductions, which can reduce taxable income substantially. Additionally, many areas provide incentives for rehabilitating historic properties, offering tax credits for the cost of repairs up to a certain percentage of the property’s value.

Another strategic approach is to optimize loan terms and interest rates. Property tax rate borrower requirements often involve substantial upfront payments or long-term commitments. By securing loans with lower interest rates through reputable lenders, investors can reduce the overall tax burden over time. For example, refinancing existing mortgages to take advantage of current market conditions can free up cash flow for strategic reinvestments or tax savings. Moreover, understanding and adhering to property tax rate borrower requirements is essential; maintaining timely payments and adhering to specific reporting standards are non-negotiable to avoid penalties and maintain favorable borrowing terms.

Tax-efficient investment strategies also encompass timing and diversification. Investors should stay informed about potential changes in property tax rates at both the local and national levels, as policy shifts can dramatically affect portfolio performance. Holding a diversified range of properties across different sectors and regions can provide some protection against fluctuating tax landscapes. For instance, mixing residential, commercial, and industrial holdings might offer varied tax advantages, depending on each asset’s specific characteristics and market demand. Lastly, consulting with fiscal experts specializing in real estate investments is invaluable; they can guide investors through complex regulations, ensuring compliance and maximizing legitimate tax benefits.

Maximizing Deductions: A Comprehensive Guide

Maximizing deductions is a strategic approach for investors to navigate the complex landscape of property tax rates. Understanding the property tax rate borrower requirements is paramount as it significantly influences financial planning. The current environment presents unique opportunities for savvy investors to optimize their tax positions. For instance, many jurisdictions offer incentives and exemptions tailored to encourage real estate investments, particularly in revitalizing urban areas or encouraging first-time buyers. These measures can substantially reduce the effective property tax rate for borrowers.

One key strategy involves leveraging depreciation, a widely accepted method for recovering the cost of property improvements over time. Investors can deduct a portion of their property’s value each year through depreciation schedules, effectively lowering taxable income and, consequently, the overall property tax burden. Furthermore, staying informed about local tax laws and regulations is essential. Some regions provide breaks for specific types of properties or investment strategies, such as historical structures or energy-efficient renovations, which can further enhance savings.

To maximize benefits, investors should consider consulting professionals who specialize in property taxation. These experts can guide borrowers through the intricacies of property tax rate calculations, ensuring they meet all requirements. By staying proactive and utilizing available deductions, investors can make informed decisions to optimize their returns while adhering to legal constraints. This strategic approach not only minimizes financial strain but also paves the way for long-term investment success in today’s dynamic market.