Understanding local property tax rates is crucial for borrowers and investors. These rates, based on assessed property value, impact annual taxes and financial planning. Variations stem from budget needs, property values, and tax laws. High rates don't guarantee better services. Borrowers should assess service quality, property values, and costs. Regularly checking local budgets and comparing assessments helps predict trends. Optimizing property tax rates through exemptions and deductions improves financial health, fosters trust with lenders, and enhances loan terms.

Understanding and navigating property tax rates is a cornerstone for both real estate investors and homeowners, as these rates significantly impact financial decisions and community development. With variations across regions and complexities arising from assessment methods, calculating property tax rates can be daunting. This article provides an authoritative guide to dissecting and analyzing these rates, offering practical insights that demystify the process. We’ll explore key factors influencing rates, present actionable strategies for evaluation, and equip readers with the knowledge to make informed choices regarding their real estate investments and residency.

Understanding Property Tax Rate Basics

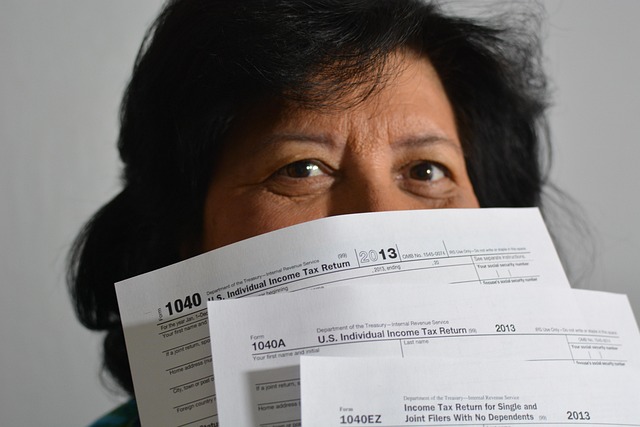

Understanding property tax rates is crucial for both homeowners and borrowers as it significantly impacts financial planning and overall property ownership experience. The property tax rate is a percentage used to calculate the amount of tax levied on real estate properties based on their assessed value. This rate, often referred to as millage or assessment ratio, varies by location and can differ widely across jurisdictions. For instance, in 2022, the average effective property tax rate in the United States ranged from a low of approximately 0.5% in some states to over 2% in others.

A property tax rate borrower requirement is typically expressed as a percentage of the property’s appraised value. Lenders use these rates to determine the annual property taxes that a borrower must pay as part of their mortgage agreement. For example, if your home is assessed at $300,000 and the property tax rate is 1.5%, you would be responsible for paying approximately $4,500 annually in property taxes. It’s essential to understand these rates can fluctuate annually due to changes in local budgets, property values, or tax laws, making it critical for borrowers to stay informed.

Expert analysis suggests that a high property tax rate doesn’t necessarily correlate with better public services. In fact, some areas with lower tax rates offer comparable or superior infrastructure and amenities. Therefore, when evaluating a property’s financial burden, it’s crucial to consider not just the tax rate but also local service quality, property values, and other associated costs. For borrowers, this knowledge can empower them to negotiate better loan terms, explore alternative financing options, or strategically plan for future property investments.

Assessing Local Tax Rates and Assessments

Understanding local property tax rates is a crucial aspect of responsible borrowing and financial planning for both homeowners and investors. Property tax rates vary significantly from one locality to another, influenced by factors such as school funding needs, infrastructure development, and local government services. This variability underscores the importance of assessing these rates before making significant real estate investments or financial decisions.

Local governments assess property values using various methods, including comparative market analysis, income approach, and cost approach. The assessed value is then leveraged to calculate the property tax rate, which is typically expressed as a percentage of the assessed value. For instance, in cities where schools are highly funded, property tax rates might be higher than in areas with less demanding local services. Borrowers should consider these dynamics when evaluating potential loan payments, as the property tax rate borrower requirements can vary by as much as 300% or more across different neighborhoods within a single metropolitan area.

To get a clear picture, borrowers should obtain recent property assessment data from their local taxing authority and compare it with comparable properties in the area. This practice enables them to anticipate potential tax burden increases or decreases when purchasing or refinancing. Additionally, staying informed about local government budgets and service priorities can provide valuable insights into future tax rate trends. By integrating this level of analysis into their decision-making process, borrowers can make more informed choices that align with their financial goals and long-term plans.

Calculating Your Property's Tax Obligation

Calculating Your Property’s Tax Obligation is a critical step for any real estate investor or owner, as it directly impacts their financial planning and overall return on investment. The property tax rate, expressed as a percentage of your property’s assessed value, is the primary factor in determining these obligations. Understanding how this rate is calculated and what influences it is essential to meeting borrower requirements and managing fiscal responsibility.

The process begins with local governments assessing the value of a property, often employing professional appraisers who consider factors like location, size, age, and market trends. This assessed value forms the basis for calculating the property tax due. In many jurisdictions, tax rates are set as a percentage of this assessed value, ranging from 1% to 2% or more, depending on local regulations. For instance, in urban areas with high real estate values, property tax rates might be higher compared to rural or suburban regions. A borrower seeking financing should anticipate these costs, as lenders often factor them into loan eligibility and interest rate determinations.

To illustrate, consider a residential property valued at $300,000 in a city with an average property tax rate of 1.5%. The annual tax obligation would amount to $4,500 (300,000 x 0.015). This calculation underscores the importance of considering property tax rates when evaluating investment opportunities or planning financial strategies. Expert advice suggests that borrowers should aim for a comfortable buffer in their budgets to accommodate fluctuations in these rates, ensuring they meet lender expectations and maintain fiscal stability.

Strategies to Optimize and Reduce Tax Burden

Optimizing property tax rates is a strategic approach that can significantly impact a borrower’s financial health. Property tax rate borrowers often face challenges in navigating their tax obligations, but with careful planning and specific strategies, these hurdles can be reduced. One effective method is to understand and leverage the various exemptions and deductions available for real estate owners. For instance, many jurisdictions offer exemptions for primary residences or certain types of businesses operating within residential properties. By availing themselves of these benefits, borrowers can legally lower their tax burden.

A crucial aspect to consider regarding property tax rates is the borrower’s financial situation and long-term goals. A responsible approach involves analyzing the property tax rate in relation to the borrower’s income and ability to repay. For instance, a borrower with a higher property value and correspondingly elevated tax rate might explore refinancings or loan modifications that can restructure their debt and potentially reduce monthly payments, thereby alleviating the tax burden. Additionally, staying informed about local market trends is vital; property values fluctuate, and these changes directly influence tax rates. Early detection of these shifts allows borrowers to make proactive decisions.

The relationship between property tax rate borrower requirements and financial planning cannot be overstated. Lenders often require borrowers to demonstrate a stable income and responsible debt management practices. Optimizing property taxes aligns with this requirement by showcasing fiscal responsibility. For example, a borrower who successfully reduces their tax liability through legal means can present this as a positive financial achievement. This approach fosters trust between lenders and borrowers, enhancing the chances of favorable loan terms and conditions. Moreover, it encourages borrowers to engage in regular financial assessments, ensuring they remain informed about potential savings opportunities.